Estate Planning Attorney for Beginners

Get This Report on Estate Planning Attorney

Table of ContentsHow Estate Planning Attorney can Save You Time, Stress, and Money.Not known Details About Estate Planning Attorney A Biased View of Estate Planning Attorney9 Easy Facts About Estate Planning Attorney Described

Your attorney will likewise assist you make your records authorities, arranging for witnesses and notary public trademarks as essential, so you do not have to bother with trying to do that last step on your own - Estate Planning Attorney. Last, but not least, there is useful comfort in establishing a partnership with an estate planning lawyer that can be there for you down the roadwayBasically, estate planning attorneys give value in lots of methods, much beyond merely providing you with published wills, trusts, or various other estate preparing records. If you have questions regarding the procedure and desire to discover a lot more, contact our workplace today.

An estate planning attorney helps you define end-of-life decisions and legal files. They can establish up wills, establish counts on, produce healthcare directives, develop power of lawyer, create succession plans, and more, according to your wishes. Functioning with an estate planning attorney to finish and oversee this legal paperwork can aid you in the complying with 8 areas: Estate intending attorneys are specialists in your state's trust, probate, and tax laws.

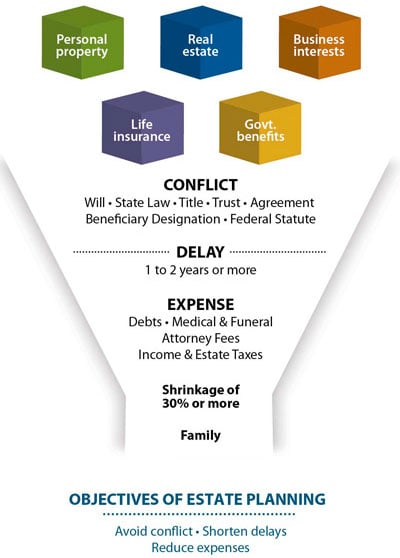

If you do not have a will, the state can decide just how to divide your properties among your heirs, which could not be according to your desires. An estate planning lawyer can help organize all your lawful files and distribute your assets as you desire, potentially staying clear of probate.

Examine This Report on Estate Planning Attorney

As soon as a client passes away, an estate plan would certainly determine the dispersal of possessions per the deceased's instructions. Estate Planning Attorney. Without an estate strategy, these choices might be delegated the next of kin or the state. Obligations of estate organizers include: Creating a last will and testament Establishing up count on accounts Naming an administrator and power of lawyers Recognizing all beneficiaries Calling a guardian for small kids Paying all debts and minimizing all tax obligations and lawful costs Crafting directions for passing your worths Developing preferences for funeral arrangements Settling instructions for treatment if you become unwell and are not able to choose Getting life insurance policy, handicap earnings insurance, and long-term treatment insurance A good estate strategy should be updated regularly as clients' monetary situations, individual inspirations, and federal and state legislations all evolve

Similar to any kind of occupation, there are qualities and abilities that can assist you this content achieve these objectives as you collaborate with your customers in an estate coordinator role. An estate planning job can be right for you if you possess the complying with traits: Being an estate planner suggests believing in the long-term.

Estate Planning Attorney for Beginners

You should assist your customer anticipate his/her end of life and what will occur postmortem, while at the very same time not home on dark thoughts or emotions. Some clients may become bitter or troubled when contemplating fatality and it might fall to you to aid them with it.

In case of death, you may be expected to have countless conversations and ventures with making it through family members regarding the estate plan. In order to excel as an estate coordinator, you may need to stroll a great line of being a shoulder to lean on and the private depended on to connect estate preparation issues in a prompt and expert manner.

tax obligation code changed thousands of times in article source the 10 years in between 2001 and 2012. Expect that it has actually been changed even more ever since. Depending upon your customer's financial earnings bracket, which may advance towards end-of-life, you as an estate organizer will certainly need to keep your client's possessions in complete lawful conformity with any kind of regional, government, or worldwide tax obligation legislations.

The Definitive Guide to Estate Planning Attorney

Acquiring this qualification from companies like the National Institute of Certified Estate Planners, Inc. can be a solid differentiator. Belonging to these expert groups can confirm your skills, making you a lot more appealing in the eyes of a prospective client. In addition to the emotional incentive helpful clients with end-of-life planning, estate organizers appreciate the advantages of a steady income.

Estate planning is a smart thing to do regardless of your existing check here health and wellness and financial condition. The very first vital thing is to employ an estate planning lawyer to aid you with it.

The percentage of people that don't recognize exactly how to obtain a will has actually boosted from 4% to 7.6% given that 2017. A skilled lawyer knows what info to consist of in the will, including your beneficiaries and special considerations. A will certainly protects your family from loss due to immaturity or disqualification. It likewise offers the swiftest and most reliable approach to transfer your assets to your beneficiaries.